US stocks fell on Friday as more details over a global IT outage trickled in and the major averages failed to recover from a sell-off that saw the Dow snap a run of wins.

The S&P 500 (^GSPC) fell 0.7% while the tech-heavy Nasdaq Composite (^IXIC) declined 0.8%. Both the Nasdaq and S&P 500 posted their worst week since April. The Dow Jones Industrial Average (^DJI) slipped almost 1%.

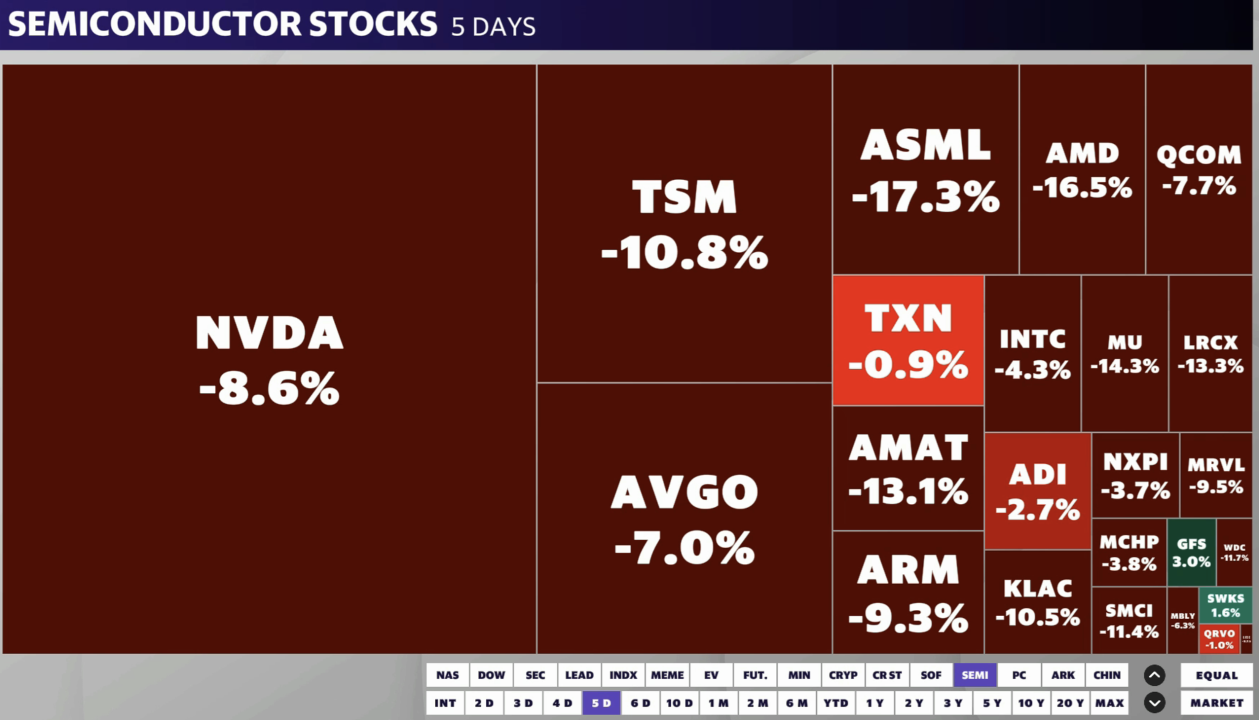

Stocks fell after a wobbly handful of sessions that saw a dive in tech, with AI-focused chip stocks bearing the brunt. Investors are rotating out of the tech heavyweights that have fueled the recent rally and into small caps, seen by some as benefiting more from interest-rate cuts.

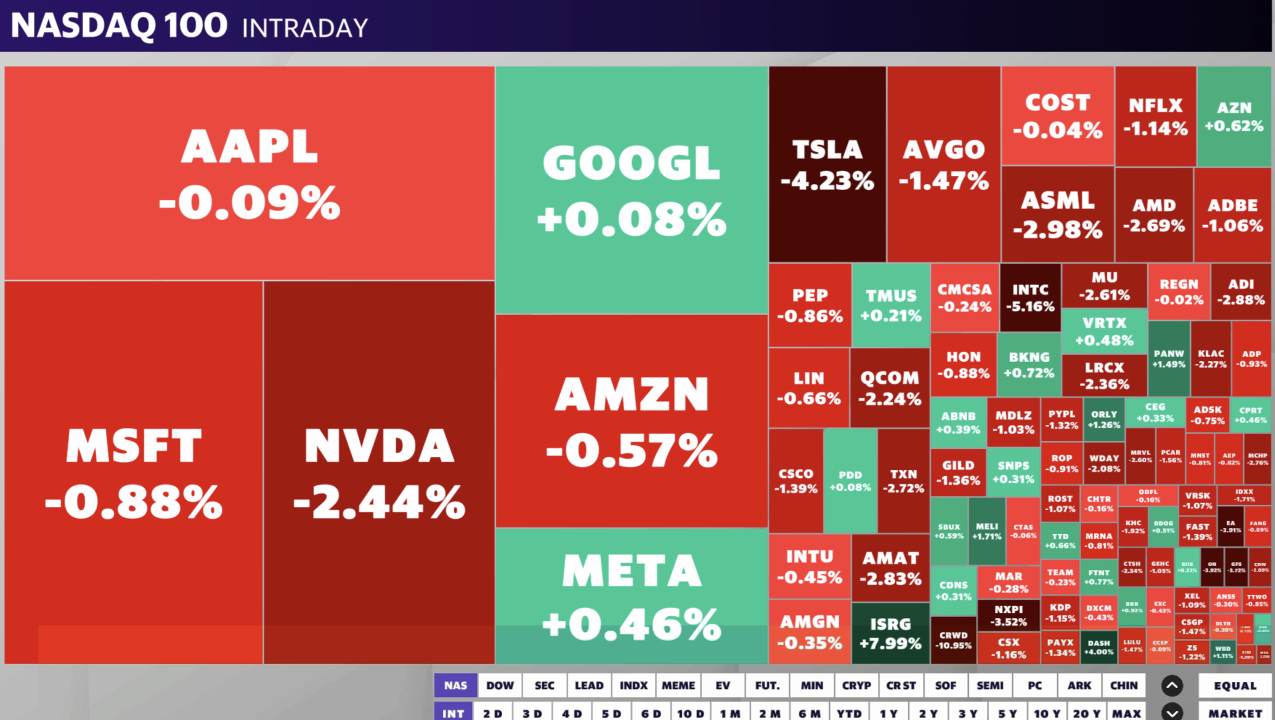

In the early hours, investors assessed the potential impact of an “unprecedented” failure in computer systems worldwide that grounded flights and hit banks, telecoms and media companies, among others. But concerns eased after CrowdStrike (CRWD) said a fix was in place for the glitch, a botched update that affected Microsoft-based (MSFT) systems.

CrowdStrike shares plunged as much as 20% as the outage spread, but pared losses to 11%. Shares of Microsoft — which was working on problems with its Azure cloud services — were down less than 1%.

Meanwhile, Republican presidential contender Donald Trump used his nomination speech on Thursday to say he would “end the electric vehicle mandate on day one.” His comment comes as the market wakes up to the “Trump trade” — the implications of his policies for assets if the former president takes the White House.

Next week investors will get another glimpse at the state of the consumer and economy when more earnings roll in, including quarterly results from beverage giant Coca-Cola (KO), delivery service UPS (UPS) and EV maker (TSLA).

LIVE COVERAGE IS OVER12 updates

Read More