TAMPA, Fla. — Israel’s Gilat Satellite Networks announced plans June 17 to buy Stellar Blu Solutions, a Texas-based aircraft equipment integration specialist, in a deal worth up to $245 million to chase the emerging market for multi-orbit Wi-Fi on planes.

The boards of both companies approved the transaction, but it remains subject to multiple regulatory approvals, including the green light from the foreign investment watchdog in the United States.

Gilat mostly provides satellite broadband equipment on the ground, although it also offers modems for planes in addition to ground stations for inflight connectivity (IFC) providers.

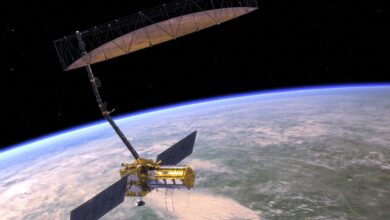

The Israeli company is looking to leverage Stellar Blu’s terminal platform, which incorporates electronically steered array (ESA) technology from Ball Aerospace (now part of BAE Systems) to enable planes to connect to Ku-band satellites across geostationary and low Earth orbit (LEO).

Intelsat has been testing the ESA with Eutelsat OneWeb to combine broadband from their geostationary and LEO satellites, respectively, for IFC services slated to begin this year. Their multi-orbit aviation customers include American Airlines, Alaska Airlines, Air Canada and Aerolineas Argentina.

Panasonic Avionics of California, one of the largest IFC providers alongside Intelsat, also plans to use the ESA to combine OneWeb LEO connectivity with capacity leased from geostationary satellite operators.

Gilat CEO Adi Sfadia told investors in a call about the acquisition that the company also plans to sell the ESA to non-airline customers, although Stellar Blu does not have exclusive rights to the technology outside the aviation market.

The Israeli company has also been developing a LEO-only ESA for business and government customers, and Sfadia said it plans to start shipping nearly 200 of the antennas to Florida-based IFC provider Satcom Direct next year.

“We will have several sets of ESA antennas that the customers will be able to pick and choose,” he said. “In the longer term, we will focus … probably on one set of antennas.”

He said Gilat expects the introduction of low-profile, multi-orbit ESAs with no moving parts will help create an IFC market worth between $700 million and $1 billion annually over the next 10 years.

Deal details

Gilat plans to pay Stellar Blu $98 million after closing the transaction before the end of this year, and up to $147 million more over two years if the combined group achieves business and financial objectives.

Stellar Blu has sold a backlog of nearly 800 terminals, according to Sfadia, and is on track to post annual revenues ranging from $100 million to $150 million beginning in 2025.

Publicly traded Gilat recorded $266 million in revenue for 2023, of which he said several tens of millions of dollars came from the IFC segment.

Stellar Blu also recorded a loss in EBITDA (earnings before interest, taxes, depreciation, and amortization) in 2023, and Sfadia said the U.S. company is looking at another loss for 2024 as initial antenna shipments have only recently begun.

“We expect them to show some revenues this year,” he added, “but it depends on production ramp-up.”

Gilat’s expansion into the IFC market comes as other established geostationary players also seek to fortify their position with low-latency LEO services amid mounting competition from SpaceX’s Starlink broadband constellation.

Related

Read More