Sat 13 Jul 2024 ▪

5

min of reading ▪ by

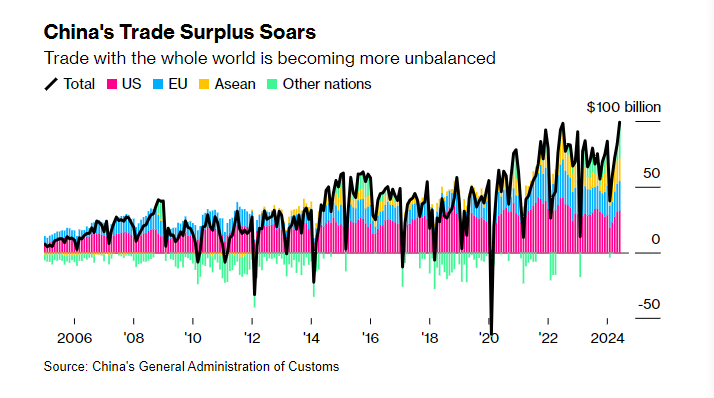

Governments around the world are increasingly concerned about China’s unstoppable economic rise. The Chinese conquest on a global scale is marked by a massive export of goods, creating a worrying trade imbalance. This text examines the roots of this phenomenon, its implications for the global economy, and the measures taken by various countries to address it.

Trade: A Miraculous Cure for Chinese Economic Problems?

Have China’s economic problems dissolved so quickly when the figures were abysmal some time ago? The huge Chinese trade surplus has elicited many international reactions.

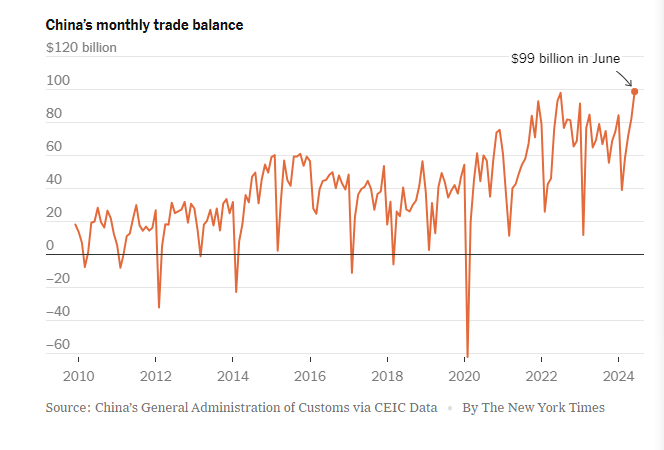

In June, Chinese exports reached $308 billion, marking an increase for the third consecutive month, while imports fell to $209 billion.

This situation created a record trade surplus of $99 billion, exacerbating the economic imbalance with China’s trading partners.

This surplus is largely fueled by weak domestic demand, which drives China to turn to foreign markets to sell its products.

This dynamic, however, comes at a cost. In response to this flood of Chinese products, several countries, including the United States, the European Union, and Brazil, have imposed new taxes on Chinese imports, notably on electric vehicles and household appliances.

These trade tensions are a symptom of a deeper malaise: China uses its trade surplus to compensate for weak domestic demand and a crisis-ridden real estate market.

Falling apartment prices, which constitute a large part of Chinese household savings, have reduced domestic consumption, forcing the country to export more to keep its economy afloat.

China’s Financial Strategy

Finance plays a central role in China’s strategy to maintain its economic growth. With millions of people seeking to save in response to the real estate crisis, the Chinese government has redirected bank loans from the real estate sector to the manufacturing industry.

New bank loans to industrial borrowers reached $614 billion over the twelve months up to March, six times more than annual loans to these borrowers before the pandemic.

This massive reallocation of financial resources is an attempt to offset the slowdown in the real estate market by boosting industrial production.

However, this policy is not without risks. Manufacturing overcapacity could lead to a drop in the prices of exported products, exacerbating existing trade tensions with foreign partners.

Moreover, focusing on industrial expansion rather than stimulating domestic demand could prolong China’s economic problems in the long term.

Chinese officials hope that increasing exports will keep factories open and create jobs, but excessive dependence on foreign markets could backfire if trade relations continue to deteriorate.

A quote from economic expert Bruce Pang sums up this situation well:

“The record surplus could also fuel those quick to judge China’s manufacturing overcapacity and perceived dumping practices to bolster trade.”

This statement illustrates the challenges China, recently interested in bitcoin mining (BTC), faces as it attempts to navigate an increasingly hostile global economy.

Impact on the Global Economy

The repercussions of China’s trade surplus on the global economy are significant. Massive Chinese exports, combined with weak domestic demand, mean that other countries must absorb an increasing amount of Chinese goods, jeopardizing their own local industries.

In response, many governments have intensified protectionist measures, raising tariffs and imposing trade barriers to protect their national industries. These actions risk escalating into a full-blown trade war, with potentially devastating consequences for the global economy.

The trade imbalance with China is not limited to the United States and the European Union. Countries like India, Turkey, and even Brazil, a member of BRICS, also feel the effects of the flood of Chinese products on their markets.

Growing tensions within BRICS are particularly revealing: despite their common goal of reducing economic dependence on Western powers, China’s rise creates friction.

Brazil, for example, has recently imposed a heavy tax on Chinese imports, a clear sign of the fear of Chinese economic hegemony, even among its supposed allies.

Maximize your Cointribune experience with our ‘Read to Earn’ program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

Click here to join ‘Read to Earn’ and turn your passion for crypto into rewards!

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.