Apple‘s (NASDAQ: AAPL) stock has popped 18% in the last month. Various factors have driven growth, such as a first look at its artificial intelligence (AI) platform Apple Intelligence, reports of increased product sales, and expectations that the Federal Reserve could soon lower interest rates (which would allow for lower borrowing costs).

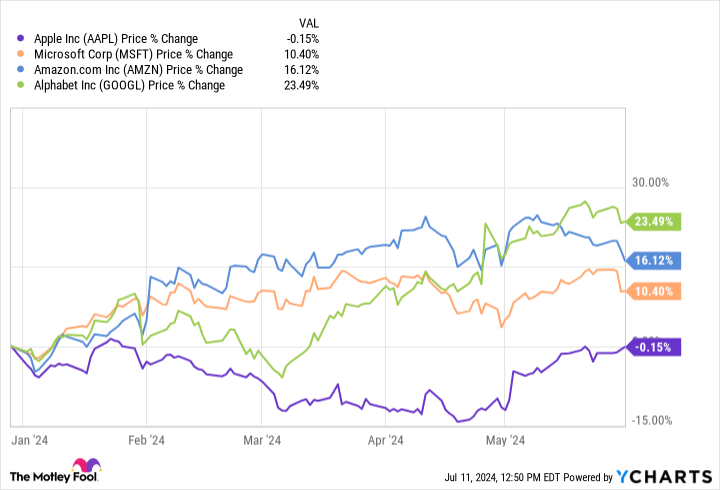

The rally is a welcome change after dismal growth for much of the first half of 2024. The chart above shows that up until June, Apple’s stock had actually declined, underperforming when compared to some of its “Big Tech” rivals. Apple’s lack of growth primarily stemmed from concerns over revenue declines in its products business and its lack of a position in AI.

However, the iPhone company appears to be turning things around with changes in its product strategy. Meanwhile, Apple has market trends on its side, with a bull market sending the S&P 500 up 56% since October 2022.

The tech giant appears to be on a growth path. Here are two reasons to buy Apple stock like there’s no tomorrow during this bull market.

Earnings season is right around the corner

Apple’s second-quarter results (posted May 2) were fairly positive, despite revenue dipping 4% year over year. Net sales of $91 billion beat Wall Street expectations by $190 million. Meanwhile, earnings per share (EPS) of $1.53 rose above forecasts by about $0.03. After significant growth in its digital-services division, the company enjoyed an overall rise in gross profit margins, hitting 47%.

However, Apple could be in for an even better Q3 2024 (which it will report Aug. 1), with expected boosts in its Mac and iPhone segments.

Data from IDC shows a PC market recovery has continued into the second quarter, rising 3% year over year. Lenovo, HP, and Acer experienced increases between 2% and 14% during the period. However, Apple delivered the most growth, with sales in its Mac segment soaring 21%.

Moreover, recent reports indicate a significant boost to iPhone sales in China, Apple’s third largest market. According to Bloomberg, iPhone shipments in the East Asian country jumped 40% in May after rising 50% in April. Sales in China have been a sore point for Apple this year, declining 8% year over year in Q2 2024 amid rising competition from domestic brands like Huawei.

Apple has responded to the declines with heavy discounts on its products, which appear to be paying off. Discounts can sometimes be a short-term solution to a problem. However, consumers’ tendency to rarely switch operating systems when it comes to smartphones could play in Apple’s favor as the sales potentially create long-term customers.

The coming iPhone release will likely unveil Apple’s next push into AI

Like clockwork, Apple unveils its latest iPhone lineup every September, and 2024 is no different. However, this year’s iPhone launch could be one of its most crucial to date, with the company expected to extend its push into AI.

iPhone sales decreased 10% year over year in Q2 2024, alongside declines in other product segments. As the highest-earning part of Apple’s business, the smartphone division appeared to be in need of an overhaul. As a result, Apple is strategically using its AI expansion to boost iPhone and other product sales.

In June, the company announced Apple Intelligence, an AI platform created to enhance user experience across its lineup. Tools such as image and language generation, significant upgrades to Siri that will allow access to OpenAI’s ChatGPT, and more are meant to simplify everyday tasks with AI.

During the presentation, Apple revealed only iPhone 15 Pros and higher will be able to access Apple Intelligence. Meanwhile, Mac and iPad users will need devices equipped with the company’s M1 through M4 chips to enjoy the features.

Apple Intelligence is slated for a fall release, just in time for the launch of the iPhone 16. It’s unknown what other features the new smartphone will include, but it will be the first iPhone explicitly designed with AI in mind. As a result, the smartphone could boost sales in the coming months and encourage shoppers to upgrade to other products in the lineup that have access to Apple Intelligence.

Bloomberg reported on July 10 that Apple has told suppliers it’s targeting about 10% growth in iPhone 16 shipments after iPhone 15 sales hit 81 million in the second half of 2023.

Potentially worth its premium price tag

Apple’s stock is trading at about 35 times its forward earnings, which means it doesn’t offer the best value. However, its proven ability to increase profit margins and cash flow could make it worth its premium price.

Boosts in product sales will likely lead to further growth in its digital-services segment as users take advantage of the new AI features. The company’s AI push has opened the door to countless growth opportunities and ways to monetize its offerings in the coming years.

In addition to hitting $102 billion in free cash flow this year, Apple remains an attractive long-term buy that could be on the brink of a rally.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, HP, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

A Bull Market Is Here. 2 Reasons to Buy Apple Stock Like There’s No Tomorrow. was originally published by The Motley Fool

Read More