1 Incredibly Cheap Artificial Intelligence (AI) Stock to Buy Before It Skyrockets

The proliferation of artificial intelligence (AI) has given a big boost to technology stocks in the past year, which is evident from the 30% gains clocked by the Nasdaq-100 Technology Sector index during this period. But not all companies in this sector have benefited from the adoption of AI.

Twilio (NYSE: TWLO) is one of those names, as shares of this provider of cloud communications services are down 11% in the past year. The company’s slowing growth due to weak customer spending has played a central role in its poor showing on the stock market.

However, Twilio stock has started gaining some momentum of late. But can this cloud stock keep heading higher? Let’s find out.

Twilio could be blessed by the growing AI adoption in contact centers

Twilio’s application programming interfaces (APIs) enable companies to build communications tools and stay in touch with their customers through various channels such as text, email, voice, chat, and video. The company’s services allow customers to replace traditional contact centers, which require investments in real estate and equipment such as computers and servers, with cloud-based contact centers.

The good part is that the market for cloud-based contact centers is expected to generate $86 billion in revenue in 2029 as compared to this year’s estimate of $26 billion — a compound annual growth rate of 27%. AI adoption in call centers is also expected to grow at a healthy annual pace of 23% through 2030, producing $7 billion in revenue at the end of the decade as compared to $1.6 billion this year.

Twilio has generated $4.2 billion in revenue in the past year, indicating that both cloud contact centers and the proliferation of AI within the same are going to be tailwinds for the company. More importantly, it has already started offering AI tools to customers.

On its May earnings conference call, management said that Twilio has made “progress on a number of our AI products.” The company has already launched Agent Copilot, which will be the first of the three AI-focused products to be embedded into its communications solutions this year.

Twilio says that Agent Copilot will give customer associate agents deeper insight into customer behavior by analyzing real-time data, thereby “automating and enhancing agent productivity while reducing resolution times.”

Beta testing by Twilio’s clients suggests that they are indeed able to reduce the time spent while addressing the needs of their own customers. In the words of CEO Khozema Shipchandler:

Agent Copilot and unified profiles are currently in public beta, and customers, like [online college] Universidad UK, are already leveraging these capabilities within their contact centers. As a result, they’ve driven a reduction in handle time by 30%. And by using our embedded AI automation tools, they’ve been able to deflect 70% of support cases in just two months.

More importantly, the company’s Customer AI platform, which it made available to clients in the third quarter of 2023, is also witnessing an improvement in adoption. As such, Twilio should ideally be able to win a bigger share of clients’ spending in the future as it launches more AI-focused products.

A potential turnaround could be in the cards

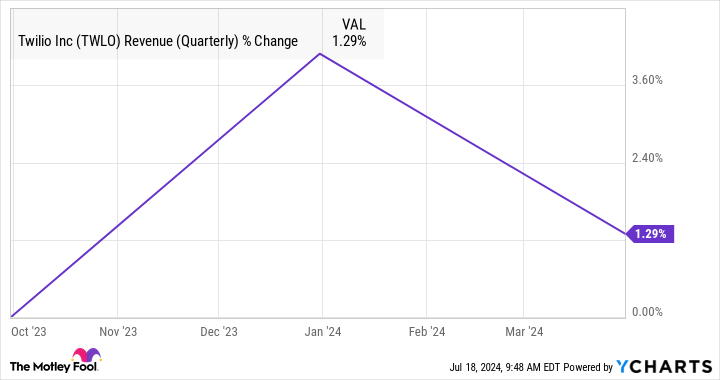

Revenue in the first quarter of 2024 was up 7% year over year on an organic basis, while overall revenue increased 4% to $1.05 billion. The company exited the quarter with 313,000 active customer accounts, which was up from 300,000 in the same period last year.

However, its dollar-based net retention rate came in at 102%, not a strong figure. This metric compares the spending by Twilio’s customers during a quarter to the spending by those same customers in the same quarter a year ago. A reading of more than 100% means that its customers adopted more of its offerings or extended their use of their current ones. So the net retention rate in the first quarter indicates that existing customers’ spending barely improved.

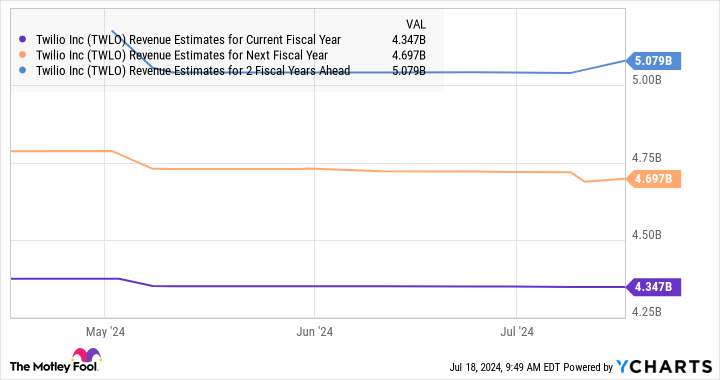

For the full year, management is forecasting an increase of 5% to 10% in its organic revenue. Analysts expect its overall top line to jump 4.6% in 2024 to $4.35 billion. But as the adoption of Twilio’s AI-centric services improves, its revenue growth is also expected to get better, as shown by the following chart.

The chart also tells us that analysts have increased their revenue expectations for 2026 of late. And earnings are forecast to increase at an annual rate of almost 20% for the next five years.

This potential improvement in Twilio’s growth is the reason investors should consider buying this cloud stock, since it trades at just 2.6 times sales right now, a discount to the U.S. technology sector’s average of 8.4.

Also, it’s trading at 21 times forward earnings, which again represents a nice discount to the Nasdaq-100’s forward earnings multiple of 30 (using the index as a proxy for tech stocks). Twilio carries a 12-month median price target of $69, according to 34 analysts covering the stock, which would be a 16% jump from current levels. The 12-month Street-high price target stands at $110, suggesting a potential jump of 85%.

If Twilio’s growth indeed starts improving thanks to AI, there is a solid chance that it will be able to put its underperformance behind and deliver healthy gains, which is why investors can consider buying it while it is still cheap.

Should you invest $1,000 in Twilio right now?

Before you buy stock in Twilio, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Twilio wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,626!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Twilio. The Motley Fool has a disclosure policy.

1 Incredibly Cheap Artificial Intelligence (AI) Stock to Buy Before It Skyrockets was originally published by The Motley Fool

Read More